Talibs Weekly Email - Week 38

🚴♂️The Economics of Tour De France, 🛢️Exxons Downfall & 🛒The Costco Membership for Luxury

Good Morning,

Hope everyone is enjoying their summer. I took 3+ weeks off to refresh on some ideas, bask in NBA ball and just zone off from any long form reading/podcasts.

I’ve appreciated all the reads and thought invoking discussions from everyone so far. I look forward to sharing more of them soon!

Cheers,

What I’m listening to as I write this weeks email

Tweet that got me thinking

🚴♂️ The Economics of Tour De France

🛢️ Exxon’s stunning decline

🛒The Costco Membership Model Comes for Luxury Fashion

Articles

🚴♂️The Hustle: The Economics of Tour De France

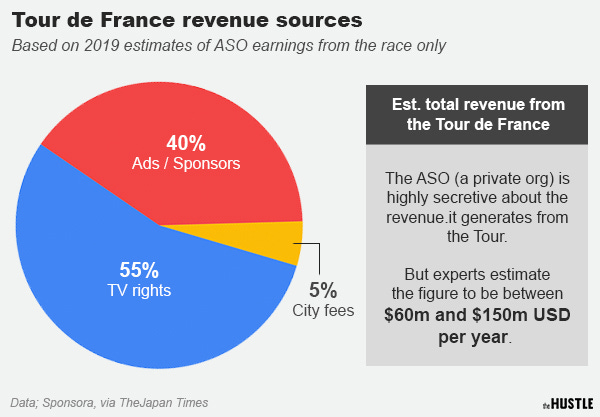

TLDR: The Tour De France relies heavily on sponsorship and tv rights. Cycle teams also are heavily dependent on sponsorships. There is almost minimal revenue from fans.

🚴♀️When was the Tour de France? The Tour De France just concluded last week with Tadej Pogacar of Slovenia winning the elite race this year. The race usually occurs in June however due to COVID; it had ben postponed to August 29 to Sept 20.

🇫🇷How does the world’s most prestigious cycling race make money? For the past 55 years, the Tour de France has been “owned” by the Amaury Sport Organisation (AMO). The AMO is a private organization and usually been quite secretive with finances and reports speculate they they generate anything between $60 million to $150 million.

📺How do they make the money? TV Rights! The ASO makes 55% of the total revenues from TV Rights and and approx 40% from Ads. It can be expensive to be a part of the route but municipalities are willing to pay.

💰Lets dig into the Sponsorships.

Sponsorships (40%) are still critical to the race’s bottom line and have significantly evolved. Among them:

Publicity caravans: There is no fee for spectators to come and watch the race; there are tons of spectators and a vast majority of spectators come out to see this “parade” more than the race itself. Its basically a procession of 250 vehicles, around 12 miles long that takes 45 minutes to pass. They hand out many items to fans such as t-shirts, keyrings and random things. Brands paid around $250K to $600K just to be in the caravan.

Special jerseys: There are 4 unique jerseys worn by riders; yellow for the leader, white for the best young rider etc. The bank LCL spends $12m a year to have its name on the yellow jersey.

🖼️TV broadcasting rights (55%) have now been sold in 186 of the world’s 195 countries. Streaming this race requires a crew of 260 cameramen, 35 vehicles and 6 planes. One major deal with the national french tv is worth $25m per year alone.

💸Who sponsors the teams? The tour this year had 178 cyclists on 22 different teams; these teams are all private and there isn’t much public information about their costs. All in - today’s teams approx. easily exceed a $20m annual budget; they don’t sell any tickets and they don’t even have their own merch. They rely on sponsorship & donations alone.

70% of their budgets comes from the title sponsor which pays the team between $5m to $15m a year to name the team and plaster those logos everywhere.

The return to sponsors is quite hefty; research firms concluded that the average team was worth $88.4m in media exposure to a title sponsor. This is based on a 2012 study.

Take a look at the title sponsors of this year’s 22 Tour de France teams:

🚴How much do the Riders make? The total prize money at the Tour De France is relatively small at $2.7m, the overall winner of the race gets $595k and each overall placing gets a diminishing amount down to $1.2K for 20th to 160th place.

Its obvious that their earnings hinges on sponsorship; many pros make around 3.5m per year depending on their sponsor. This amount is based on view-ability and winnings. The riders formulate strategies to get maximum view-ability for their sponsors. This could mean not winning but just being in “prominent” viewable sections of the race at times.

💭My Thoughts: This was a very well researched article by the Hustle. Overall - it comes down to sponsors (large conglomerates) and the race makes all the money in the world. The fact that organization is quite secretive about their finances does raise some eyebrows but then again its a private organization and what I’ve learnt is that Racing - be it Formula 1 or Biking has big conglomerate names behind it for maximum advertiser value.

🛢️The Journal: Exxon’s Stunning Decline

TLDR: Exxon has lost approx. 60% of its value since 2013 and this has led Exxon being excluded out of the Dow Jones Index.

💸Exxons great valuation: In 2013, Exxon was the biggest U.S company by market cap; since then it has lost approx. 60% of its value with market cap around $160 billion.

📉Exxon losing money: Exxon made $46 billion in profits in 2008 and they are expected to lose $1 billion this year; the company was removed from the DowJones earlier this month after being on the index for over 100 years.

👇How did Exxon get here? Exxon struggled extensively through a period of low oil prices due to the abundance of oil due to the US Frackers. Rex Tillerson (Former CEO and if you remember the Secretary of State for DJT) made some big bets on projects around the world that failed to meet expectations.

Between 2009 and 2019, Exxon spent $261 billion on capital expenditures while adding $45 billion in debt. The Return on capital declined from 16% to 4% last year. Exxon got into the shale business its peak with minimal return and their large risky investments in the Arctic and Canadian oil sands haven’t been pretty.

🍃What about competitors? BP and Shell have accelerated their embrace of renewables, BP has restructured their internal structure to plan to have renewables on par with their oil & gas. BP has pledged to be net carbon zero by 2050; they’ve formulated a plan that sees the company being transitioned from an oil & gas company to an “energy” company and thus dramatically increasing their investment in renewables.

🌍Are they gonna make the same type of money? BP & Shell have concluded they probably won’t make the same type of money out of Oil but do know that they can depend on a steady return if they slowly transition into renewables. They’ve concluded that the future of oil/gas may not be so bright.

🛢️What did Exxon do? Exxon decided to double down on their investing in oil infrastructure projects during the period of low prices pouring billions around the world. Exxon invested heavily in the last 10 years by increasing their net debt over the last little while.

🇺🇸Exxon believes the world’s growing population will need fossil fuels for decades to come and that the company’s bet on additional production will yield profits in the long run. Oil demand has stalled during the pandemic, but it has been rising for much of the past century. Exxon believes that oil prices will go up and they’ll have the production to meet the demand while their competitors will not.

⛽️Best Case for Exxon: New Markets: They are really betting on Africa, India & China as they believe the rising middle class will need more energy and Exxon will be able to get to the. They don’t that renewable infrastructure is cheap enough to gain adoption in the developing economies.

👎Worst Case for Exxon: The worst case if renewables become significantly cheaper and climate change becomes a larger issue in these developing countries.

💭My Thoughts: This is a unique differentiation in strategy between the two oil conglomerates. The longer term horizon appears starkly different between the different oil companies; with one doubling down on their current field while others are looking to diversify and innovate.

🛒Article: The Costco Membership Model Comes for Luxury Fashion

TLDR: E-commerce companies are adopting an annual membership model which allows them to offer products to their consumers at lower prices while spending considerably less on marketing

💳Which company is doing this? E-Commerce Site Italic has been catering to individuals who favour a discreet-under-the-radar style. Italic began in 2018 raising over $13 million as yet another millennial direct to consumer clothing brand. The site offered unbranded clothes, shoes and bags produced by the same factories that all other luxury brands use.

💸Why do this? By aligning itself with establishment brands, Italic Inc. doesn’t have to spend what other DTC startups have had to shell out to build consumer trust: A $36 hoodie feels less cheap once you read—in large type under the picture—that it’s made in the same place as a $375 Armani version.

The difference in prices are significant as they claim the manufacturers also make the same products for High designer brands. $200 vs $995!! (But it’ll cost you $100 a year ) Sorry Canadians - they don’t ship to Canada yet.

👜What did they do? Despite providing a unique quality product at low prices; the company has suffered similarity to all the retail brands have faced this year. In July, the company moved to a members-only model, Italic customers must pay $100 a year to access the 800 products on site.

🎽Are there other companies doing this? There are a few luxury retailers that have been testing this model, companies such as Restoration Hardware offers a grey card which costs $100 and offers exclusive access to flash sales and discounts.

💭My Thoughts: This is interesting at best and showing that quality does not always hundred percent correlate to the price. If you can get an “Armani” quality shirt for an affordable price or at cost. We’ve all known the power of marketing but I think the crowd that wears these luxury brands do not care if the same item is under $100; they care if the logo is visible or not. From a company perspective, loyalty is hard to get in e-commerce as consumers flock to various deals and cost per acquisition gets higher and higher. This way brands can lock in that consumer annually and slowly up-sell on certain high margin products.

I remember being in Guangzhou, China in 2016 for the Canton Fair and remember speaking to factories/manufacturers who claimed they made shirts & shoes for UnderArmour. I asked about prices and it was something around $4 per shirt; I’m sure there are other costs such as shipping etc but this freedom that companies in China can sell their products to others was interesting and maybe in violation of their direct agreements.

Books of 2020

Here are my books to read/finish for the next while

Completed

Educated by Tara Westover (9/10)

Loonshots by Safia Bahchall (8/10)

Range - David Epstein (7/10)

American Dirt by Jeannine Cummings (9/10) [fiction]

The Ride of a Lifetime - Robert Iger (9/10)

If you’re looking for books to get, I would suggest checking out bookdepository.com or thriftbooks.com (both are cheaper than amazon at times

As always fantastic content Talib - appreciate this!