Talibs Weekly Email - Week 33

Trucking Industry Woes 🚚, Fortnite vs Apple 💲, The alternative ways to IPO💹

Good Morning,

Hope everyone had a great weekend and enjoying the last bits of the summer. Hope everyone is staying safe and taking care of themselves.

What I’m listening to as I write this weeks email

Tweet that got me thinking

💲 Fortnite’s Battle Royale with Big Tech

💹Economist: The IPO is being reinvented

Podcast:

TLDR: The Trucking industry has been known for years as a path to middle-class life but in the last few decades; the business has changed due to consumer pressure for lower prices and thus this has put the cost savings directly on the workers themselves.

🚚How does one get involved in the trucking industry? The long distance trucking industry states are recruitment heavens as they are often recruiting drivers for their companies; in-fact- they need to recruit quite a lot because turnover in this industry is an astonishing 100%.

📚What about training? Many of the large trucking companies made drivers do as little as 3-4 in-class sessions and a virtual simulator before they’re sent out on the road to drive goods across the country. Research has indicated that new truck drivers are 41% more likely to get into an accident than experienced ones. Essentially - its quick & cheap.

💰Money? As workers start as employees of the company; they’re often told the potential riches they can make as an independent contractor. Essentially the trucking companies pay their employees $0.37 per mile and they encourage their employees to be independent contractors to earn more than that if they can “hustle” through. The trucking companies classifies its owner-operators as contractors — and therefore not privy to certain worker protections.

🗝️But why be an employee when you can be your own boss? The company offers to allow the driver to take out a loan to buy a truck on them; offer them insurance through the company and give them a company credit card to pay for gas.

💰The cons? Contractors get trapped into never-ending loan payments, cannot work for any other company, do not get paid for idle time and may have to wait until there are shipments. They lose money and at times see bill payments from the companies instead of paycheques.

⌛️How did this happen? How do groceries get all these products in their shelves for such a lower price? The trucking industry has been facing competition and they’ve found a model that works - eliminating employee costs as much as possible & doing everything on the cheap.

Lets look back into a quick history lesson?

⏲️1950s - local trucking unions started joining forces to create a giant national union. The unions leverage power to get a great deal for their workers. This props up salaries and benefits. Truckers at the time made better wages than autoworkers and steelworkers at the time.

⏳1970s - The political divide started occurring and in the midst of the cold war - de-regulation and government involvement in lower prices were key focal points in elections. Congress decides to re-write the rules and starts regulating all kinds of industries.

💹De-regulation: It became very difficult to run a profit as a trucking company due to consumer pressures on lower prices; the old trucking companies couldn’t keep up and within 10 years of de-regulation, all but five of the largest 50 were gone.

🚛Trucking Industry: There is no brand loyalty here with customer service etc; their customers which are the big box chains want lower price at all costs. Trucking companies scrambled to lower costs wherever possible.

💰How to turn profitable again? The pressure on trucking companies forced them to get rid of expensive unionized labour, companies started making their drivers stay out on the road more, eliminating hotels (opting to sleep in the truck), they cut benefits and wages all the way down.

⚖️Lawsuits? There have been a wave of class action lawsuits by the mega carriers, PAM transport paid $16.2 million to their workers, Prime settled for $28 million for misclassifying their employees as independent contractors and violating min. wage laws. The $28 million got distributed to 40,000 people..end result was $700 in their pockets. These are settlements so the transport companies do not admit to any wrong-doing and keep going with their actions. The winners in this - corporate lawyers.

💭My Thoughts: What an interesting episode; we often associate trucking industry with significant number of accidents due to long-working hours and overnight trips. This episode goes deeper into the root causes of those long hours; essentially our desire for cheaper goods and the lack of regulation has allowed the trucking companies to creatively reduce overhead. The fact that the industry has a 100% turnover rate is terrifying!

Podcast

Journal: Fortnite’s Battle Royale with Big Tech

🍎What happened? Apple & Google removed “Fortnite” from their app stores as “Fortnite” violated payment rules escalating battle over the fees the two big companies charge developers.

💸What is this payment issue? Apple launched the app store in 2008 allowing developers to create apps to be used on the iPhone; further they had implemented a 30% fee for every transaction done on the iPhone for any developer. 30% of all in-app purchases or app purchases made on the iPhone were paid to Apple.

🕹️What is Fortnite? Fornite is an online multiplayer game that has over 350 million registered users worldwide across multiple platforms. The game is owned by Epic Games which also boasts other games and apps such Houseparty Inc. The game is free to download on all platforms

🆓But if its free; how do they make the money? Fortnite makes a significant amount through in-app purchases such as “skins” for your character or “dances” for your character as low as $0.99.

🎮So not having this game on the App-store is going to hurt Epic: Fortnite generated about $46.6 million in in-app spending over the last 30 days on Google and Apple.

Okay lets gets back - what did Fortnite actually do?

Fornite launched their own payment system within the latest version of the app.

📲They integrated their own Epic Direct payment system in the latest version allowing users to pay directly to Epic. They also discounted the price significantly to encourage users to do so. This would allow Epic to avoid the 30% fees. Apple did not like this as it is clearly stated with the apple app policies that in-app payments can only be done through Apple.

🍎Okay so do other companies have issues with this too?

The quick answer is Yes; a number of other app developers such as Netflix, Match Group (tinder etc) and Spotify have complained about the 30% commission. Iphone sales have been slowing down and Apple has relied heavily on its services business to foster continued growth. Services revenue jumped to 15% this past quarter to $13.1 billion.

💭My Thoughts: The Apple 30% fee has been consistent since 2008 and as Apple has recorded significant growth in this service business in the last few years as iPhone sales have slowed down. Its an interesting dilemma however Apple does provide the utmost importance on privacy hence they are able to charge the higher fees. Further, if you notice - companies cannot advertise a lower price if you were to purchase directly through them. Many companies offer discounts on their websites to purchase access such as Wall Street Journal or even Tinder. You can get Tinder Gold for a fraction of the price online - however Tinder is not allowed to advertise this price elsewhere. Same goes for The Economist or Wall Street Journal.

Article

💹Economist: The IPO is being reinvented

💸What are the issues with the traditional IPO: There have many been qualms but entrepreneurs and venture capitalists have had two main complaints about the IPO process

They are a rip-off with 5-7% going to bankers

Degree of scrutiny from outside regulators and investors can be uncomfortable

💰Are there other ways to go public? Other than the traditional IPO route; there have been a wave of two alternative techniques for going public. They are

Direct Listing

Blank Cheque companies.

🔢The # of companies IPO-ing: > talk about decrease < . Amazon went public in 1997, only 3 years after formation and now we have companies like Airbnb or Uber (who waited xx of years before going public). The main reason is the rise of venture capitalists but also that most tech firms are asset light so they can go more with the $ they raise as opposed to heavy manufacturing companies in the past.

👨💼Traditional IPO: This has been the traditional route with bankers acting as the middlemen between the firm & investors negotiating a price. Its an expensive process with investors/regulators grilling managers for months. Banks charge fees from 4-7% of the proceeds raised and at times sell the firm’s share at a discount rate to please their clients at investment funds to get the initial “pop” on the first day of trading. See

💹Alternative Option 1: Direct Listing: Companies have resorted to this method of going public and instead of a banker - the stock exchange sets the initial price based on the supply/demand. The direct listing does not allow the company to raise any funds but rather creates a market for existing shareholders to sell their shares at the market price. Slack opted to go public this way and Palantir could also look this way too.

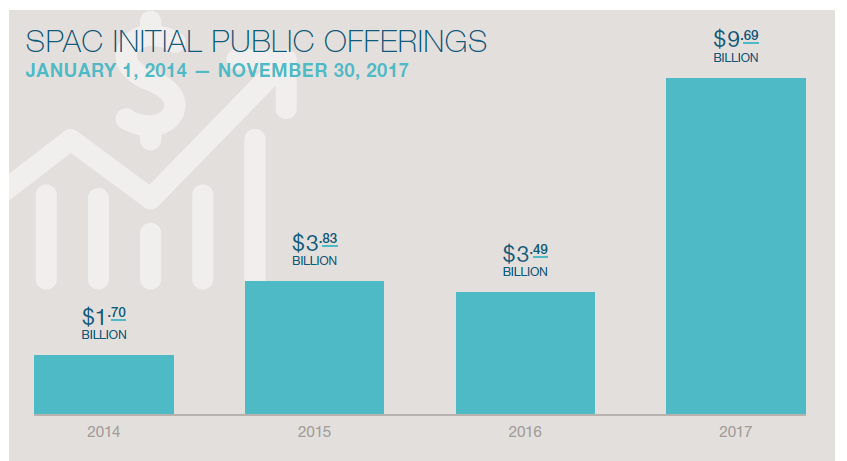

⏲️Alternative Option 2: Special Purpose Acquisition Companies (SPAC). These are basically shell companies that acquire private firms. SPACs begin by going through the IPO process, offering shares to investors. Typically, the proceeds from the IPO are held in trust while the SPAC seeks a takeover candidate. SPACs usually have a time-frame in which they seek to acquire a company; if that time period expires - the SPACs will return their capital to the investors.

The process for doing the subsequent merger is simpler than it would be to file a full set of registration paperwork with the

💭My Thoughts: SPAC is basically a bet on the executives and hoping they’ll make the right pick. Usually, you bet on the IPO and the company whereas this is betting on the fund managers to make the right purchase that would elevate your portfolio. I can see more companies going this way until the SEC clamps down and adds way more regulation to how these can be conducted.

Books of 2020

Here are my books to read/finish for the next while

Completed

Educated by Tara Westover (9/10)

Loonshots by Safia Bahchall (8/10)

Range - David Epstein (7/10)

American Dirt by Jeannine Cummings (9/10) [fiction]

The Ride of a Lifetime - Robert Iger (9/10)

If you’re looking for books to get, I would suggest checking out bookdepository.com or thriftbooks.com (both are cheaper than amazon at times